1687, Apple fell on Newton's head and he discovered Gravity.

2016, We don't know what fell on India's head but, we did discover UPI.

Speak of digital payments in India and the first topic that takes centre stage in the discussion is the national treasure 'UPI' (Unified Payment Interface). Since its establishment in 2016, UPI has had a whirlwind journey across eager consumer adoption and hundreds of use-cases built using it. It has simplified the payment infrastructure and solved the problem of interoperability, which legacy systems are burdened with.

While UPI has been integral to India's progress towards a cashless economy, it has introduced new complexities in the competition landscape of payment service providers. With this piece, we will retrace the journey of UPI and take a look at its rippling effects across the broader financial ecosystem.

Too Fast, Too fUPIous! 🏎

UPI began its journey in April 2016, just before the landmark event that would change the landscape for cash payments in India - Demonetisation. The demonetisation of ₹500 & ₹1000 currency notes that took place in November 2016 had far-reaching effects on the economy, but what emerged as a silver lining of an event which inconvenienced many was the rapid uptake of digital payments. UPI was there at the right place at the right time. Building on these factors, e-wallets like Paytm, PhonePe & Mobikwik saw users growing day by day.

Payment volumes in UPI apps were skyrocketing month on month, and Google Pay wasn't even in the picture yet! Google Pay, or Tez, as it was initially coined, was launched in September 2017, almost 10 months post-demonetization. The way it managed to overtake and take the leading position will be covered further in this piece.

While UPI was enjoying its limelight, it was conveniently eating into the market share of other payment methods. Debit & credit cards grew at an average of 30% between FY17 to FY18, while UPI grew almost 700% during the same period. Between FY18 to FY19, cards grew 28%, while UPI grew 143% - taking over both payment types in value and volume. Vroom vroom UPI!

Reminds us of that time Paul Walker hit that NOS button in his very first street race in The Fast and The Furious. What 👏🏼a 👏🏼scene!👏🏼

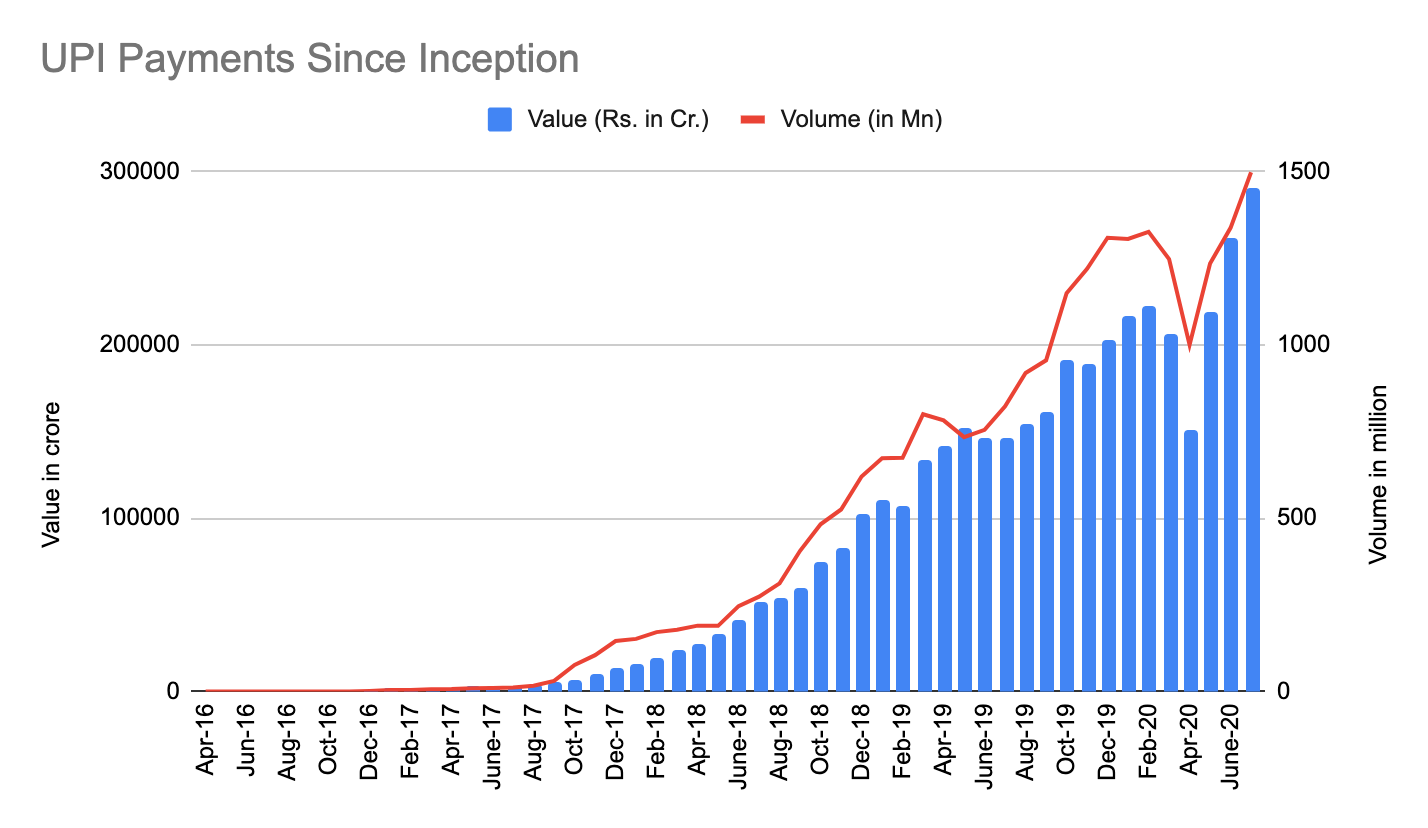

Source: RBI Data

While UPI payments have been growing year on year since 2016, there came to be another impactful event in 2020. We don't think we even have to spell it out, but - COVID 19 - the very apparent and unfortunate elephant in the room (no offence to elephants, we love them 🐘❣️). From the economy to the Mumbai locals, everything hit snooze and UPI payments were no exception.

The volume of UPI payments plummeted 24% from Feb 2020 to April 2020, while the monthly value took a 32% downturn during the same period. However, the depression in payments didn't last long. By June the metrics had recovered completely and are happily continuing their multiplication journey to growth. July 2020 recorded Rs. 290,537 crore UPI payments, the highest ever to date. This definitely seems like a good sign and provides some hope for economic recovery as we wade through this pandemic.

Source: NPCI

UPHayye, Now That's What We Call User Experience! 🤩

UPI has built an underlying network of connectivity in such a seamless way that users can transact without having to worry about the underlying banks being compatible. If we were to compare, it could be described as similar to a correspondent banking system like SWIFT, but way more efficient and quick.

With the recent hype of embedded finance being the future, we fail to realize we're already living in the beginning stages of it since 2016. Plastic cards may have been the first iteration of embedded finance, but UPI is taking it to the next level. Whether you're shopping online or buying groceries from your nukkad shop, UPI has been embedded so brilliantly into the end-to-end buying process that we don't even realize its presence.

Any transfer of money from one individual or entity to another is essentially a payment transaction. Investing? You make a payment for your SIP. Buying Insurance? You make a payment for the insurance premium. Taking a loan? Your repayments' are yet another recurring payment. Shopping online? Make that payment through UPI. This is how UPI becomes a building block in endless financial & non-financial use cases that involve any transfer of money.

India Stack which began with the Aadhaar system in 2009, followed by e-KYC, e-Sign, UPI, and Digital Locker, set out to create the technological building blocks of Digital India. As depicted above, payments are core to an economy - almost like the blood that flows through an economy's veins. Therefore, an innovative disruption like UPI fits right into the ideology of India Stack.

Having the government seal of approval also aided UPI in its widespread acceptance and adoption. UPI has now become not just an option, but a way of financial being - similar to its older counterparts like NEFT, RTGS & IMPS (all facilitated by NPCI - more on that ahead 👀)

‘Better luck next time’: A Bait By The Big Fish🎣

Paytm: Mere paas ticket booking, travel booking, wealth, insurance, loans, credit card hai. Tere paas kya hai? 💁🏻♀️

Google: Mere paas UPI hai. 😎

As much as UPI is a blessing for us, the users, it has disrupted the market by leaving a few players to enjoy the icing on the cake. Wonder where the cherry is? It’s with the sticker-inventor - Google Pay, who facilitates ~44% of the total UPI transactions. PhonePe being the second to it has a 36% share and PayTM with a big name, smaller game provides for 10%. That’s right, 90% of the UPI transactions are done via these 3 apps. 🕵️♀️

Between April 2017 and March 2018, UPI transaction value grew over 15 times and that is just the start of this story. Over the years, UPI transactions have been growing at an average of 700%. Amidst this, Google Pay launched its offerings in September 2017 which was a definite threat for the two peers. Not only was Google Pay known for giving better cashback, but in 2019’s festive season - Diwali, Google Pay launched the “collect and exchange stickers for cash” program which was one of the most successful gamification techniques to generate traction and retain customers.

By the end, not everyone got a rangoli sticker but they surely did start using GPay more often for their brilliant UX and regular cashback. In 2019, Google Pay spent nearly ₹1000 crore on cashback which is no biggie for Google but, PhonePe spending ₹1200 crore and PayTM spending around ₹3000 crores is a number to be noted.

A fact about us Indians is that we truly enjoy savings, be it as low as 2 rupees from a roadside vendor. An article from Financial Express said that 42% of users preferred digital payments only for the cashback. So, is Cashback the oxygen for UPI’s survival?

During COVID days in India, we saw PayTM come up with a whole new set of cashback offerings as a result of which Paytm saw a 3.5 times growth in this period. The preference of no-touch payments was an obvious beneficiary to this. However, for how long will these companies have to lure us with cashback offerings and spend 40-60% of their total expenses on it? How will they really make money?

The answer to this question turns out to be one bold word “DATA”. None of these companies make money via UPI transactions, especially now when the MDR is zero. For giants like Google and One97, the consumer spending insights along with their ability to partner and cross-sell products are the major source of revenue. Imagine a day when you decide to buy a phone and pay using Google Pay. Initially, they will cross-sell an insurance product at the time of purchase. But, Google Pay being a part of the Google fraternity, you will most likely see an earphone or mobile cover ad while browsing the very next day. On the other hand, Paytm is running well in the race of becoming a super-app using “mini-programs” which practically has every need of your day including news, games, shopping, travelling, food, and healthcare. Data is really the new oil.

Tussi Na Jao MDR 🥺: What Are The Banks Left With?

When UPI started in 2016, only 21 banks were live. This number as of July 2020 has reached 164! Over time, banks stopped competing and started collaborating with payment players.

UPI is the technological pathway to facilitate payments, while banks are the warehouses these paths connect. Think of it this way - you are a warehouse (bank) and the government is building highways (UPI) near you to improve connectivity. Said highway will pass through your land (Core Banking System) and enable more efficient logistics (faster settlements), but it will also mean third party entities accessing your property as and when they wish (increased volumes). Now, the two options you have are - (a) opt-out of the highway plan and remain isolated or (b) opt-in and enjoy the benefits of connectivity while also taking on the responsibility of increased activity.

This was essentially the conundrum faced by banks. The adoption of UPI brought on increased payment volumes and load on the core banking systems with minimal revenue, whereas non-acceptance led to missing out on the opportunities of customer adoption & ecosystem connectivity. The only saving grace in this equation was the merchant discount rate (MDR) - the percentage commission charged to merchants on transactions routed through the bank.

However, even that avenue of income was snuffed out in Budget 2020, when the government decided to wipe away MDR to zero on UPI & RuPay transactions of merchants with annual turnover above Rs. 50 crores. While the move was to encourage the adoption of digital payments among businesses, financial institutions lost all of their incentive in the game. Were they supposed to allow millions of UPI transactions to be processed through their systems by barely earning a penny out of it? Seems like it.

While the zero MDR rule is still applicable, the jury's still out. Just last month, NPCI voiced its opinion that MDR should be brought back to some extent to incentivize financial institutions. In our opinion, the prior and current states of existence are pretty extreme ones. What may turn out to be a better alternative would be to find a middle ground where both service providers like banks & PSPs would benefit and at the same time businesses would still find digital payments a better alternative to cash. Given the systemic changes brought on by COVID, digital payments are becoming the consumer's first choice day by day. A progressive rate structure depending on turnover or a flat yet lower percentage of fees could be possible solutions, but we guess only time will tell.

To add more mirch to the masala, banks took it upon themselves to create their own revenue streams. Select commercial banks announced charges on P2P UPI transactions beyond a set limit, applicable from April 2020. Seems fishy, right? How did the regulators allow this? We thought so too, but apparently it was legit. Here comes the twist though - just a couple days back the Central Board of Direct Taxes pulled it's 'Rishtey mein toh hum tumhare baap lagte hai' move and demanded banks refund all charges levied on UPI transactions citing the Payments and Settlements Act 2007. Seems like justice has been served, folks.

Treasure (UP)Island 🏖💰

A peculiar trait of us Indians is that we do not trust anyone who is not a bank when it comes to money. Keeping cash in wallets has always been a pain point and that’s how we fell in love with UPI. While the UPIs growth story is touching the skies, payment wallets are hitting all-time lows. The smaller players like Mobikwik or FreeCharge are severely impacted as they cannot afford to spend on cashbacks now when the top three players have the power of data.

Adding to their difficulties, one fine morning Facebook bought a stake in Jio with a very aggressive aim to build the Jio platform and making their way to launch Whatsapp pay, a cakewalk. If someone with a user base of 400 million people launches a one-button pay, even Google would feel the heebie-jeebies.

The hype around digital payments in India resulted in e-commerce giant Amazon and cab-hailing service player Ola to launch their own payment arms with a final goal to provide Fintech-as-a-Feature (FaaF). However, Amazon Pay and OlaMoney are definitely not counted as a strong point in their respective success stories.

With big players falling weak in front of GPay, Paytm and PhonePe, the small players will be grasping at the straws with unmatched abilities to keep up with their cash-burn levels.

Goes without saying that the competition is unfair for smaller players and to address to this disruption, NPCI has asked apps to limit their payments if they exceed 50% of all UPI transactions in the first year of the implementation of the rules, 40% in the second year and 33% from third year onwards. Now that we’ve mentioned NPCI, we can’t not tell you about the power this organization holds. Behold!

NPCI - The Profit Machine Behind The Scene 🤑

We took a little glance at the financials of the holy mother of digital payments in India - NPCI. The company, being a Not for Profit organization, grows at a pretty impressive CAGR of ~30%.

In FY2019, NPCI made profits of 306 Cr. on an operational revenue of 901 Cr. With idle cash of a whopping ₹1054 crores, they currently have 10+ revenue streams.

This chart will give you a broader view of the division of the operational income:

Further, let’s look at what’s included in the “Payment Services”, which contributes to almost 92% of their operating revenue:

Knowing the revenue streams of NPCI, it goes without saying that, majority of the Digital Payments space of India was regulated and managed by NPCI..until now. RBI finally released a paper for the much-awaited launch of a regulatory entity for the clustered digital payments ecosystem in India. Yes, this will act as a competition to NPCI.

This to-be-formed, for-profit regulator is named “New Umbrella Entity” (NUE). It will see a participation of varied shareholders with not more than 40% of shareholding for a single promoter. The team looks strong with players like Reliance and Paytm already eyeing for participation.

In our opinion, the NUE being RBI’s move will do what it does the best - regulate. The first mover’s advantage in a country like India has been a popular way to stay strong in the game. NPCI with its existing user base is enjoying just that privilege.

To add on, just after a few hours of RBI’s release of NUE, NPCI lived it’s “and I.. am.. Iron Man 💪” moment by announcing to take their services international.

(Wait, COVID-19? Pfft, that’s no obstacle for Iron Man.)

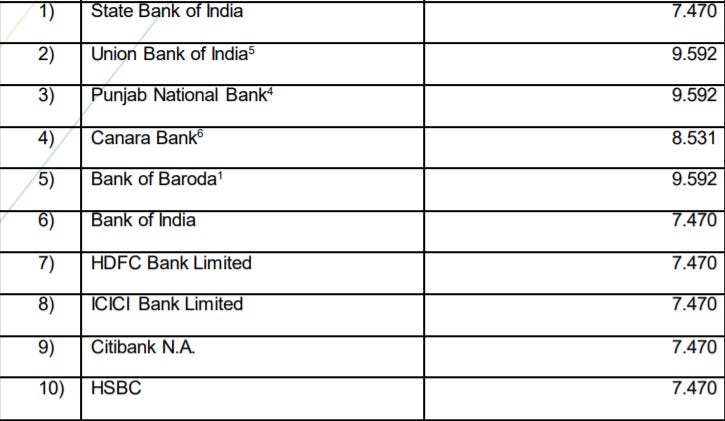

Speaking of which, NPCI has the whole army of Avengers. Yes, we’re referring to the commercial banks. Let’s go back to annual reports, just to know that the existing shareholders of NPCI include 48 Indian Banks, small to large. While 10 banks hold more than 7% of shares, the rest are 2% or below.

Source: NPCI

Unlike Iron Man, NPCI is here to stand strong. NUE though being a competitor would have to work hand-in-hand with NPCI to get the best of results for the digital payments community.

We love you 3000, UPIron Man.

To Wrap Things Up

While cash may still be king, the path ahead for UPI is definitely a glorious one. As technology grows and embeds deeper into our financial systems, more digital blocks will keep getting built. Take the instance of newly introduced Open Credit Enablement Network (OCEN) which aims to bring UPI-like seamlessness to lending, building on the India Stack components, including UPI of course. Exciting times ahead!

We hope you enjoyed this little rundown of everything UPI. Do leave your thoughts below, we'd love to discuss!

If you liked this post and would like to read more, do subscribe. Also, be the 'you guys have to read this interesting piece I found!’ friend or colleague and share this widely. 😉

Awesome

Informative and zakkash!