Magic 8-Ball Predictions for Indian Fintech in 2021🎱🧙🏻♀️

One month into 2021 and it's looking pretty much the same as 2020. But don't you worry! We're here to spice things up with our predictions for what we think will happen in the Indian fintech scene in the coming months. 🌶🌶

Read on to find out. 🧐

And if you think we missed out of something you're convinced about - fire up that comment and let us know below.

Also if you've got any fun idea for what we can do if any of these predictions come true do leave that in the comments as well 😂

We look forward to the funnn! 🥳

1. Traditional Players Turn Up The 🔥Heat🔥 For UPI

We've talked enough about NUE competing with UPI. However, is it going to happen so soon? And, will that be the only competition?

Guess not.

It'll probably be 2022 by the time we reach the summit of the battlefield between NPCI and NUE. But, the base camp will surely start to strengthen in 2021.

Currently, we see two different camps all set to battle with the best of the swords.

First is a consortium of the bosses themselves: SBI, HDFC Bank and BoB (the builder) - Kar ke Dikhayenge! 💪🏼

Reports say the trio will huddle up to form an entity under NUE, for retail payments.

This is of the essence because the trio would sum up to have a little shy of 45% of India's bank account holders. Literally, nothing stops them to form their own UPI system. Well, why need UPI if you have YONO? You only need one, right?

Kahaani me twist is, these bosses hold shares in NPCI. Will they be diluting it? Only time can say.

The second consortium is our own Motabhai's Jio. Ever heard of Jio Payment bank? Well, guess what? They have had the license for 6 years now. Existence will probably come in play once NUE launches. Their newly made allies Google and Facebook will also be partnering and participating.

Time for NPCI to buckle up!

2. Digital Lenders Face Regulatory Scrutiny 👀

Now if you don't already know what’s been happening around the Digital Lending landscape, let us give you a quick recap.

Two words: It’s BOOMING. Time and again we’ve seen positive trends on the ratio of lending startups being launched, funding being raised and, of course, the desperate demand of credit to be formalized and extended for our moonshot dream of a $5 Trillion economy becoming a fact.

Well if this bubble grows too big, too fast, it’s meant to burst. A lil’ of some bursting has happened around. Google Play store has been stormed by an army of instant credit apps offering you money in exchange for personal data (lots of it), at the cost of your arm and leg, literally. Yes, we have stories about people suiciding because they couldn’t get out of the trap.

Who knew you could type “loan” on Play Store and the next thing you’re doing is giving permissions to these small apps with untrackable origin for accessing your location and contact details, which they use to call your friends and relatives for “collection procedure”.

Ah, the torture is felt just by reading this sentence. Where is the NPCI equivalent for Lending, really?!

(Beware of ads once you actually try this on the Play Store, it's spooky.)

Fortunately, Regulatory Baap of India - RBI has taken all this into account and is setting up a panel to form regulations for digital lending. We won’t use jargons but you know the whole drill of them putting on a “robust fair practice” face.

With OCEN strengthening up its roots, we are routing for some stringent regulation acting as a protective layer from more such bubbles bursting.

Meanwhile, collection agents showing up like:

3. UPI Payments in a Shout of Crossing 5 Billion in Volume 📈

UPI has been on a roll ever since its launch. And we have a good feeling it won't be slowing down so soon, not until the NUE competitor is all set up. 👀

So we'd wager that UPI crossing 5 billion transactions in volume could be on the books for 2021.

Let's back it up with some numbers, shall we?

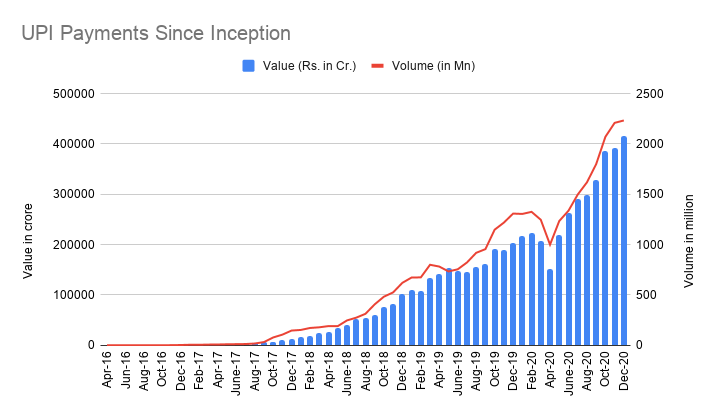

First, here's a graph that shows UPI's growth trajectory since launch - both in terms of transactions value and volume.

Now let's list out the doubling rates to the volumes:

125M+ in volume: Dec 2017: 21 months

250M+ in volume: July 2018: 7 months

500M+ in volume: Nov 2018: 5 months

1B+ in volume: Oct 2019: 13 months

2B+ in volume: Oct 2020: 12 months

Given these numbers, 4B+ in October 2021 seems like a safe bet, wouldn't you say?

Add to this a bit of guestimation of boost in volumes, 5B doesn't seem like a far reach. The increasing adoption of digital payments, more and more use cases being built on UPI and the cashless economy push brought on by COVID can easily see the domino effect bringing to fruition this big milestone for UPI.

4. Fintechs Pick Up The OCEN Building Blocks🏗

2020 saw the start of something new and monumental - The Open Credit Enablement Network (OCEN). Cousins to NPCI uncle ka pyaara baccha UPI, OCEN will be for lending what UPI was for payments.

We talked a little about it in our previous blog on India's digital lending scene, and we certainly think this will be the year that OCEN becomes legit.

So far the few use-cases live are Sahay-GeM (Loans for registered MSMEs on the Government e-Marketplace) and Sahay-GST (Loans for GST registered MSMEs).

A new fintech, Rupifi, which was born in 2020 started building its B2B SME lending solution on OCEN right from the start and has seen some promising results so far.

"The company began with its product launch in July, after signing up with restaurant and kirana aggregator platforms. Within the first month, Jain said the company has enabled INR 50 Lakh worth loans. “In the kirana segment, collections are 100% already,” he added." Source

In application, OCEN is way more complex than UPI and the end-user probably won't even know they're getting their finances fulfilled through such a network. At the back-end, however, the complexity of the network is nothing short of fascinating and seeing live use cases function smoothly has us all 🤩🤩🤩

OCEN is definitely primed for its 'Suddenly, then all at once' moment in the coming years and 2021 seems like a good start for the credit network to put on its big boy shoes.

5. FaaST!🏎 (Fintech as a Feature Time!)

Fintech has grown exponentially in 2020. It will continue in 2021. But, we bet on “Fintech as a Feature” or, “TechFin” growing at an even more accelerated pace.

What we’re implying is that we would not be shocked if by the end of this year Netflix will have a value add of “Zero Cost EMI” while paying your subscription.

We’ve got some evidence for you, that happened this year:

Apr’20: Amazon launched Pay Later Services.

Oct’20: Amazon + ICICI Credit card becomes the fastest issued credit card to cross 1 million in less than 20 months

Oct’20: Axis Bank + GPay collaborated to launch ACE credit card on VISA network.

Nov’20: RBL Bank launches a credit card with Zomato on MasterCard network.

Lastly, awaited (yet, failed) Whatsapp Pay launch.

What’s in store?

A PIL has been filed against Google, Amazon and Facebook which seeks for a detailed regulatory framework of their operations in the financial sector.

2021: The year of the Super App Revolution. Apart from Paytm, SBI YONO is closest to becoming a super app. Likes of Tata, Amazon and the charming duo of FB+Jio will be seen in the race this year. Place your bets folks!

OTT platforms, marketplaces, cab-hailing platforms and other e-commerce platforms may provide BNPL and other credit options on their apps, smoooothly while you checkout.

Our wild thoughts:

Offline retail stores (majorly the luxury brands) may provide a credit option by partnering with B2B billing startups, right at POS.

6. Indian Neo-banks Premier League 🏏🏦

Pehle aaye 811, YONO aur Digibank

Fir aaye NiYo, Open aur RazorpayX

Ab aayenge ___, ____ aur ____ (To be filled up in 2021)

Everyone wants to be a neo-bank was a big mood in 2020. The Indian fintech scene saw neo-banks popping up left right and centre.

Jitendra Gupta of Citrus Pay fame embarked on his second entrepreneurial journey with Jupiter - it's tag line being 'Nicer Digital Banking For India'.

Small business financial marketplace Chqbook rebranded itself as an SME neo-bank.

Former Google Pay execs came together to start EpiFi, a neo-bank for Indian millennials. They also scored a sizeable $13M seed round from Hillhouse Capital, Ribbit Capital & Sequoia Capital 🤑

Savings & wealth management centric neo-bank Finin came out of beta testing and made its public debut towards the end of 2020.

The already existing players in the segment like Open & NiYo also made the big moves. The SME neo-bank announced plans to expand to the Middle East, while the latter acquired mutual funda platform Goalwise.

All in all what we're convinced about is that as the global neo-banks are getting bigger than ever before, it's high time for India's neo-banking scene to start picking up pace. 2021 might just be the year given the right catalysts mingle.

And what's more, we might even see some existing fintech players pivoting into neo-banking which has been quite an evident trend in the global fintech space. 👀

7. APIs: Enabling Possibilities 🌉

Fintech Growth: Positive

Funding Trends: Positive

Adaptability: Positive

Industry Attractiveness for Non-Fintech Players: Positive

Inclusive Initiatives: Positive

Regulators Attention: Positive

Existence of Traditional Players without Fintechs: Negative

What’s the most obvious next positive trend?

Something that connects all of this and creates a whole immersive ecosystem - Yep, API Infra.

We’re super bullish on companies working as Fintech Enablers. A Plug N’ Play concept where there exists a possibility to build a whole new digital bank in a matter of a few hours.

As per our analysis, the Enterprise Tech startups had seen a growth of almost 2x in raising funds in 2020.

Considering Paytechs, last year saw device-led payments (Titan Pay), which will continue to get disrupted in the coming year. While developments on OCEN is also maturing. Concepts like these will demand the need of Fintech enablers now, more than ever!

8. Global Fintechs Set Their Sights on India 🇮🇳

Padhaaro maare des

India is a very complex yet attractive market for business. We have the right combination of demographics

- A lucrative earning population developing year by year

- Growing digitalisation in terms of smartphone & mobile internet adoption.

- Good financial & data rails (interbank systems NEFT, IMPS, UPI, Aadhar, AA, OCEN)

It's only a matter of time when global players start taking notice (which they already have) and begin making moves to secure a piece of the pie.

Remember the excitement when Netflix first launched in India?😍 Or Spotify?😍 Or Burger King?😍 Or Starbucks?😍 Or H&M?😍 Or Forever 21?😍

You get where we're going. 😂

That's the kind of excitement we feel when we think about global fintechs bringing their products to India. Imagine being able to sign up for Revolut or get your hands on one of those sleek Apple credit cards!

Just this January, UK based SME neo-bank, Tide, announced its expansion plans for India. They see the untapped potential in the country's MSME space which can't be denied.

Revolut has previously mentioned that India is definitely on its expansion list.

Apart from consumer fintechs, we could also see the entry of B2B focused fintechs in the market. Banking-as-a-service, eKYC and more.

India already serves as the backend operations destination for many global fintechs, maybe it's time that it also becomes the front end for these companies, eh?

9. Fintechs Become Dalal Street Ready 🎯

2020 was a year where we saw 12 new startups becoming unicorns. Of which, 7 were Fintechs.

Goes without saying, our love for unicorns grow with every passing year, both mythically and actually 🦄

We expect many more Fintechs to join the unicorn club this year. But, hey! We’re excited about something even bigger.

IPO listings of Fintechs!

Indian Fintech landscape has matured over time. So much so, that even in COVID affected year, the funding deals grew by 24%! Some of the Indian Fintechs are finally reaching the stage where they are all set to gain some public trust and admiration!

While Paytm and PhonePe announced their plans on going public, Policy Bazaar - one of the existing Unicorns is most definitely ready to fight the bears & bulls in 2021!

There ain’t no stopping these biggies from going big. Now that Paytm claims it might just become a profit-making entity in 2021. Finally!!

We expect more such Fintechs to go public very soon. Tears in eyes to see these few years old startups fly, over the rainbow, so high!

10. Cryptos Become Legit (🚨T&C Applied🚨)

Crypto nerds breathed a huge sigh of relief in March 2020 when the Supreme Court pulled a Bigg Boss move on the RBI and made cryptocurrencies legal in India. Since then trading volumes have been soaring and it's been raining BTC and ETH.

The recent Bitcoin rally has amped up the positive energies for cryptocurrencies worldwide and it nicely coincided with RBI possibly hinting at dabbling in CBDCs (Central Bank Digital Currencies - basically the notes & coins we use in digital form.)

Here's where things get interesting. RBI wants to bring in a CBDC, but at the same time also ban the use of private cryptocurrencies. Here's a snippet of the new proposed law from the Lok Sabha Bulletin released in Jan 2021-

2021 will definitely see India start working on a digital rupee and it is a good step towards a more cashless economy.

Banning cryptos though? Mmmm…. Not such a good move, we'd say. Given the Supreme court ruling on private cryptos, the new bill is sure to face backlash from the Indian crypto community.

Best case scenario - we emerge with some guiding regulations for crypto as an asset class. Now wouldn't that be much better?

Like the asset class itself, there's no guarantee on what might happen, but it's sure to be interesting. The only moment we know cryptos are legit when it enters mainstream fintech in India. Long way to go for that, but we'll get there.

India for cryptos 2025? ✊🏼

FintechFemme Whacky Predictions for 2021 🤪

What's the fun in predictions without some out of the box curveballs or too good to be true expectations? These are some of our wildest fintech dreams come true predictions for the Indian fintech scene:

India introduces a digital banking license. 🦾

10 Fintech Startups getting a Unicorn badge, one of them being CRED ofc. 🦄

Tables turn for Acquisitions: A fintech acquires Traditional BFSI Player. 😮

Wealthtech players introduce trading in US stocks for retail investors. 🤩

Jio + Facebook + Whatsapp start a Neo-bank. 🤯

We reserve all the bragging rights, (and Afshan’s delicious cookies) (and a bubble tea party) if any of these come true. 🤝🤤

Do share it with folks who’d love to predict Post-Pandemic Fintech Future and let us know your bets on these predictions! 🔮