Hello people! This month we're talking about that buzzword you've probably been hearing everywhere if you're in finance, especially so if in fintech - BNPL.

Non-finance folks, we know you may be thinking -

Ye kaunsa naya BSNL aa gaya? 😯

Or

Is there a new cricket premier league I don't know about? 🤨

Don't worry it's not a new company or a cricket tournament. It's a new type of financial product, more specifically a lending product which expands to Buy Now Pay Later = BNPL.

What's The Jhol? 🤔

The simplest explanation of what it is and how it works is in the name itself

Buy Now

Pay Later

What the providers of this product do is pretty simple and might sound too good to be true, and it kind of is.

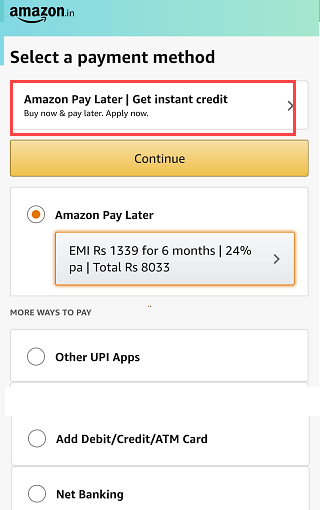

Say you're browsing on Amazon and loading up products onto your cart. You proceed to checkout to make the payment and screeeeech *halt*.

Woah, is that really the total? 👀

Umm.. should I be spending that much at one go?

Do I even have enough money to spare?

I really want to buy these things though 🥺

Now while these thoughts are going through your head, there's the solution you've been looking for all along -

Now you might be thinking - ehh, but isn't this just an EMI?

Technically, yes. But there is a difference. Let us illustrate it with this Indian-academic-system-favourite Difference Between table-

So essentially you could say BNPL is the most watered-down and least friction version of full-fledged EMIs.

No interest, minimum KYC & small ticket size make it a super attractive product for online shoppers looking to quickly fund their purchases without having to worry too much about credit card limits and the works.

Swadesi BNPL Gossip ☕️

While the term/product has only got its new-found fame in the past year or so, its history dates back quite a bit - back to the roaring, internet-booming 2000s when we were babies.

The genesis of this concept came from a Swedish fintech company called Klarna in 2005. Their goal was to help merchants & consumers with easier online payment option - hence born was 'buy now, pay later’

The company that began from Sweden slowly expanded to neighbouring regions of Norway, Finland and Denmark, and eventually more European countries. More money coming in, valuations skyrocketing and transactions multiplying - today Klarna is a $31 billion valued fintech unicorn with more than 90 million customers globally.

Klarna does have a glorious story but isn’t the only one. Over the years many similar companies have mushroomed across the world and replicated the model for online merchants & consumers - in the US there is Affirm; Afterpay, Zip Pay in Australia; Atome, Hoolah, Pine Labs in Southeast Asia; Tabby, Tamara in the Middle East; & Shahry, Carbon picking up pace in Africa.

The segment is certainly showing some serious promise and demand spurred by the digital and online-first behaviour brought on by COVID-19. Spending via BNPL options which stand at $89 billion globally in 2020, is expected to grow almost 4x to $352 billion by 2025, as per Kaleido Intelligence.

Now those are some figures to digest.

Desi BNPL Charcha 📢

EMIs have been a fairly widespread concept in India for quite some time now, but BNPL is starting to gain traction even quicker. The digital lending market in India, currently at $110 billion in 2020, is expected to grow to $350 billion by 2023, as per Medici research.

While this growth will mostly be led by bigger ticket loan products, BNPL transactions will surely contribute a chunk of this growth. Players like Razorpay, Pine Labs, Zest Money, Simpl, and many more are spearheading the growth of this phenomenon in India. These platforms have seen double-digit percentage growth in BNPL transactions over the pandemic ranging from 60% to 160%.

The segments Indians are using BNPL for are quite interesting. Let's play a small game here - we'll describe some of the segments using emojis and you have to guess which segment we're talking about.

📱🖥💻🎧🎸

🥬🥕🍅🌶🍍

👕👗👜🕶🥻👖

💊💉🏋️♂️🏃♀️

🧑🏫📚

(Here are the answers: Electronics & durables, Groceries, Fashion & Lifestyle, Medical & Health, Education.)

If you got all of these right you definitely are a Dumb Charades pro. *high five*

“2020 will be remembered as one of the most pivotal years in the adoption of Buy Now, Pay Later in India. We saw an increased trend of digitally savvy customers who prefer transparent financing options like BNPL over unfair and hidden fees associated with traditional products. The category is poised for massive growth this year as the consumer habit is here to stay. Consumers are clearly loving the all-digital experience for credit. We strongly feel India will emerge as the largest market for BNPL and will leapfrog credit cards entirely.” - Lizzie Chapman, CEO and Co-Founder ZestMoney.

The most interesting and encouraging trend emerging in India is the uptake of digital payments & even BNPL from the tier 2 and tier 3 cities of India. Zest Money has recorded 68% demand for BNPL services from outside tier 1 cities of India. Similarly, Razorpay saw over 50% of online payments volume from tier 2 & 3 cities in 2020.

This only goes to show the high demand and untapped potential for such products in India. Let's delve into some actual numbers to visualize the opportunity, shall we?

Meanwhile, We Stalked The Indian Janta A Bit 👀

There are a lot of numbers thrown around about the market size of various industry segments, but what's actually going on behind those numbers and how are they actually determined?

With these questions in mind, we thought - why not give it a try ourselves 🤷🏻♀️

So here's our somewhat wild but somewhat tame and sensible estimate at the market opportunity for BNPL in India:

Stay with us for this one.

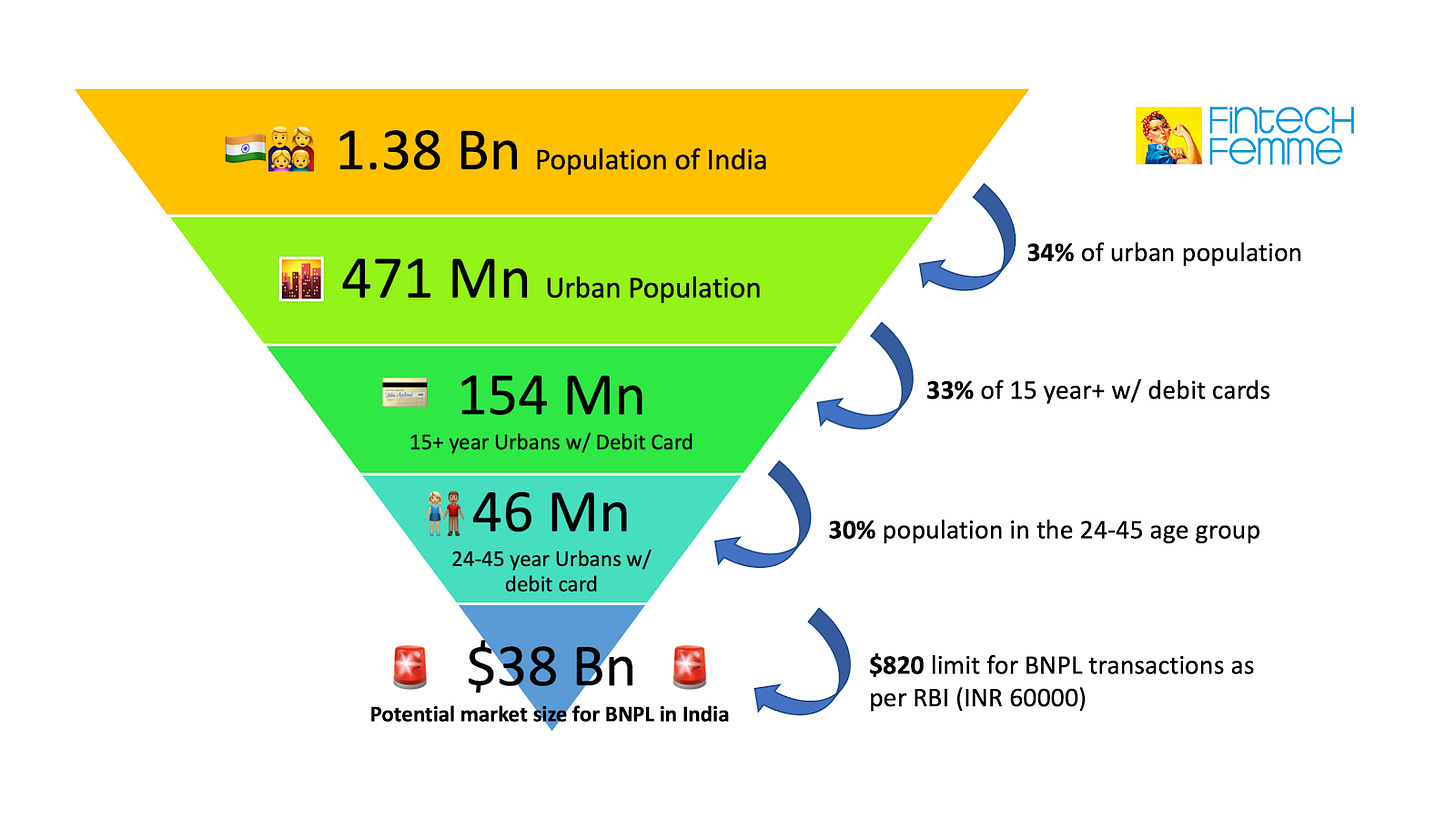

First up, we start with the population figure of India which is no number for the fainthearted - 1.38 billion (yes, with 9 zeros). The task ahead is to trim down this number to a BNPL-specific target audience.

From our secondary research we found few facts about the people using BNPL in India:

Demand for BNPL products is driven by the urban population, led by tier 2 & tier 3 cities, followed by metros.

The average age of most active BNPL users in India is in the mid-30s

The ticket size of BNPL loans ranges from Rs 10,000 to 30,000 in most cases. (RBI permits Rs.60000 of OTP-KYC based loans)

Still here?

Okay good, hang in there.

Keeping this in mind, we factored in

The urban population of India (areas having a minimum population of 5,000 of density 400 persons per square kilometre)

15+ year old with debit cards (since debit cards are prominent in India & you can't go online shopping without one and attempt to use BNPL)

24 to 45-year-old population, as these are the folks who are most likely employed & most likely to use such products.

Lots of trial and error and 'wait how many zeros is that?' later we narrowed down to the final figure.

The target market of 46 million Indians and a market value of $38 billion!!! That's the market size for BNPL in India.*****

***** Terms & conditions & trust in our calculations applied.

(Jokes aside, if any of you reading this can actually validate this or provide some inputs, that will be great. Hit us up!)

$38 billion is not a small number, but so is not the population and potential of India. Given all the favourable factors in terms of digital adoption and a cashless economy, we won't be surprised if this figure ends up being a bigger one.

With that, we rest our case. Let us know in the comments how we did 🤓

Game Banayega Name 🏏

Those were some numbers, eh? Now, let’s take a moment and take a sneak-peak behind the scenes.

If you’ve been reading our last few blogs, you know we went bonkers over how lending fintechs are money magnets.

Although BNPL is a part of the Lending family, these kids are outliers. While EMI and credit card players deal with high ticket sizes and a hefty interest on it, things aren’t the same for BNPL folks.

Let’s first talk about the two largely used BNPL models in India:

#1 - Only Online: Players like Simpl and Lazy pay who largely tie-up with e-commerce merchants and other online stores to provide a pay later option on checkout. Next time while you’re hungry and using Zomato deliver, have a look at the payment options.

#2 - Online and Offline - One large player who’s working here is PineLabs. Buyers can opt for BNPL while checking out using one of PineLabs machines, and/or while checking out of your merchant website using a debit/credit card. (Definitely, the winning one, considering larger ticket-sized EMI in offline transactions.)

Now, let’s talk about the two major revenue streams for any BNPL player:

#1 - Merchant Fee: BNPLs survive on the concept which made all our journal entries and balance sheet tally go wrong: deferred payments. (tech folks, apologies for the low relatability)

Imagine buying a subscription to your favourite music streaming platform and opting for a BNPL option at the checkout. While you aren’t shedding your money, the BNPL company takes this burden and pays the merchant right away after taking a small fee, usually ranging between 1-3% of the transaction.

Only when you pay back will the BNPL take a breath of relief.

#2 - Payment Default Charges: In case you fail to pay back, they charge a delay fee to you and that acts as a part of their revenue.

In short, BNPL benefits either when ticket size is higher, volumes are higher. Hence, it becomes a big deal for BNPL players to ensure the stickiness of consumers.

How? You know the answer.

Imagine checking out at your favourite store, not paying a huge amount right away, and earning some rewards - redeemable at any of the partner merchants of a particular BNPL.

Happy life?

Yes, but no.

Let us show you the dark side.

BNPL: Beneficial Now, Poor Later? 🤐

“Hey, can you lend me 2000, I urgently want to buy shoes? I’ll return it as soon as my salary gets credited.”

Sounds familiar? That’s at least 60% of millennials to their friends. Sometimes, friends can spoil you and we think BNPL is that friend.

They know the weakness, they benefit from that. But, how many times has this millennial failed to pay on the promised date? Oh so often.

While you may think this loan is not as big as your parents have, and that you’re planning it out, it’s a myth.

Unlike your parent’s loan, these loans are unsecured. If you are using an iPhone and have been frequently buying high-ticket size products, chances are you’ll get an unsecured credit good enough to buy Apple AirPods.

Say you bought AirPods using Amazon’s pay later and defaulted. Does that stop you from taking credit? Probably not that quickly. There are many other players who would still offer you some amount.

(Woah, that’s a privilege that even your salaried parents don’t enjoy)

Yes, because any default on their end reflects in their credit score. In this case, it remains unaffected. They probably believe the ticket size is too small to judge something as big as your credibility score. But, isn’t it these small bad habits that bundle up to get worse? Hasn’t that been the start of every bubble ever?

Well, that’s a big statement. Let’s come to the grounds and make it more relatable.

Scene 1.1: You’re in a different city for work, for a month and don't know how to cook. You gotta use Swiggy. With Simpl in existence, you can order every day and pay it at the end of the month. Sounds convenient, but would you lose the track of your daily budget? High probability.

If you fail to pay, just scroll down to find LazyPay. 🙃

You’ve literally nothing to lose and such financial situations are scary.

That’s all for the BNPL folks, “Go We Must!”

If we lightened up your brains this morning, pass it on to your sleepyhead friends as well. 🙂

See you all next month with some hot hot fintech takes! 😉