Digital Lending in India - Reality, Hype or Fantasy? 🎩

A look into the digital lending landscape of India and the opportunities it holds.

Hey hey hey! We're back 😎

So we published two articles in October and took a long break, but we’ve ensured this one is worth the wait.

In the last two articles, we spoke about the existing fintech unicorns and our best bets on who we think will make it to the list next.

While writing these articles, we noticed two very evident trends:

Digital Lending sweeping the majority of funding received by the Fintech segment. 🤑

Digital Lending ruling the unicorn and soonicorn badges! 🦄

This brought us face to face with questions like:

What’s all the hype? 🤔

What’s making Lending startups rich? 🧐

Why is everyone pivoting towards lending? 🤨

Most of all, what really is OCEN? 😯

We're going to try our best to address these Qs and we promise to be crisp this time. 🤜🏼🤛🏼

One Large Scoop of Untapped Market, Please? 🍨

Let’s dive in straight to the pool of numbers shouting out the existing market opportunity.

Largely dividing the lending landscape into two parts, we’ll see the untapped markets in both MSME and Retail segments.

MSME has been an employment charm for a long time now. It employs more than 100 million Indians at the moment. Now, as we go ahead in this article, you’ll know the ‘deets’ about lending but for now, know that if you are an MSME employee or an MSME itself, getting a loan is a nightmare. Here are some number estimates after referring to various reports:

This is just the story of MSMEs. Like we said earlier, they employ over 100 million people and an average Indian household debt currently, is INR 16,000. That’s the whitespace we’re talking about.

Coming on the retailer side, the credit market largely consists of the below offerings:

Home Loans

Loan Against Property (LAP)

Auto Loans

Personal Loans

Credit Cards

All these offerings, like any other service, are mainly dependent on two factors: demand and supply. Hate to break it to you - we have a huge gap out there.

Let’s have a look at the COVID outlook of these offerings:

Just to understand this better, let me introduce you to the long lost brother of Karan– Arjun.

Arjun is a young chap working in a kirana store, he lives with his parents so doesn’t need a house loan but he pays for his daily expenses and often finds himself short of money.

No traditional bank gives him loans because he has no collateral. He would happily take a personal loan to buy a laptop and try to take the kirana services online, which would help him earn and repay the loan real quick. Arjun is you, Arjun is me, Arjun is every non-rich person who actually needs the loan. Let’s go further and understand how Fintechs are working on this. But first, a meme.

The Soul Stone of Banking 🔶

(No Gamoras were harmed in the making of this.)

Strip down a business to its core and all it is is a profit-making tool. Yes, there is all the philosophical (and vital) stuff about creating value and yada yada, but you essentially need to survive to do that, and you need to be profitable to survive.

Blame capitalism. 🤷🏻♀️

So what it boils down to essentially is the most basic principle of any business - buy low, sell high.

Manufacturing: Produce at lower costs <> Sell at a higher price

Stock trading: Buy at a lower price, sell high at a higher price

The same thing applies to banking as well.

Here's a neat and very basic little breakdown of the business model for you:

Banks collect deposits from customers

Banks then lend those deposits to customers in need

Banks charge interest to customers for the amount lent (Sell high)

Banks then pay their depositors a % of the interest they earn through the borrowers (Buy low)

The margin interest is the bank's profit

When you think of it banks are basically just feeding you your own money and earning off of it.

Blame capitalism 🤷🏻♀️

Now, this has been going on since the start of banking in some long lost era. So you can see how lending is essentially at the core of banking. And it's a pretty effective way to earn income. Net interest margins (that's the difference between the interest earned on loans - the interest paid to depositors) vary from bank to bank. In India, it ranges from 3-4% across public and private banks.

Fintech Gives You Wiiings 💸

Now that we've understood the basics, let's look at the things from the fintech lens.

What did they bring to the table? Well, obviously the 'tech'. And also a new approach to lending. Going after the underserved segments which the big guns shied away from.

Like Elsa's magical touch, technology basically changed everything as we know it. Lending cycles which spanned from months to weeks were brought down to days and minutes. It also took out many manual aspects of the process, which reduced friction in many ways.

Multiple players emerged across the lending cycle from processing to underwriting to collections. Thus, emerged the new era of lending.

Let The Cash Flow Speak

Traditional lending relied on assets given by the borrowers as collateral. Which means if the borrower fails to pay back their loan, the lender has the security of an alternate asset which it can gain ownership of to recover capital.

This model has some major flaws:

Not everyone can provide assets as collateral

Not all assets qualify as collateral

The accurate valuation of the asset

Now, we could dive into the detailed reasoning of why asset-based loans are not ideal, but that's a story for another day. However, if you'd like to understand better, check out this article.

It's pretty evident that asset-based loans prematurely draw a line against people who cannot be eligible for traditional sources of loans.

This is where the hero of the story emerges - cash flow based lending. As the name suggests this type of lending relies on the credibility of your cash flow. How much do you earn in a month? How regularly do you pay your bills? How much do you spend and how much do you save?

This opens up the gates for a wide range of hard-working individuals to access credit even if they don't have much in terms of assets.

Aided by technology, fintechs brought about the cash flow based lending transformation. This eliminated a lot of weight from the collateral-based way of things and made lending a far more lightweight solution.

Alt-Pop, Alt-Rock, Alt Underwriting 🎸

Okay, now we've got the tech and we've got the method. Here comes the asli maal masala of it all - data.

If money makes the world go round, data are the underlying gears of it all. With the hyperlocal level of digitalisation of happening all around - data is coming out of every device near us. From local doodh walas and chemists to the likes of Google, Amazon and Facebook - humans are generating unprecedented amounts of data.

At first glance, you might think it's inconsequential stuff - like what value does my payment history with my local grocer have? In isolation, not much, but when you piece it together with all your other day to day payments, you create this web of financial history that can vouch for your ability to spend or pay back a loan.

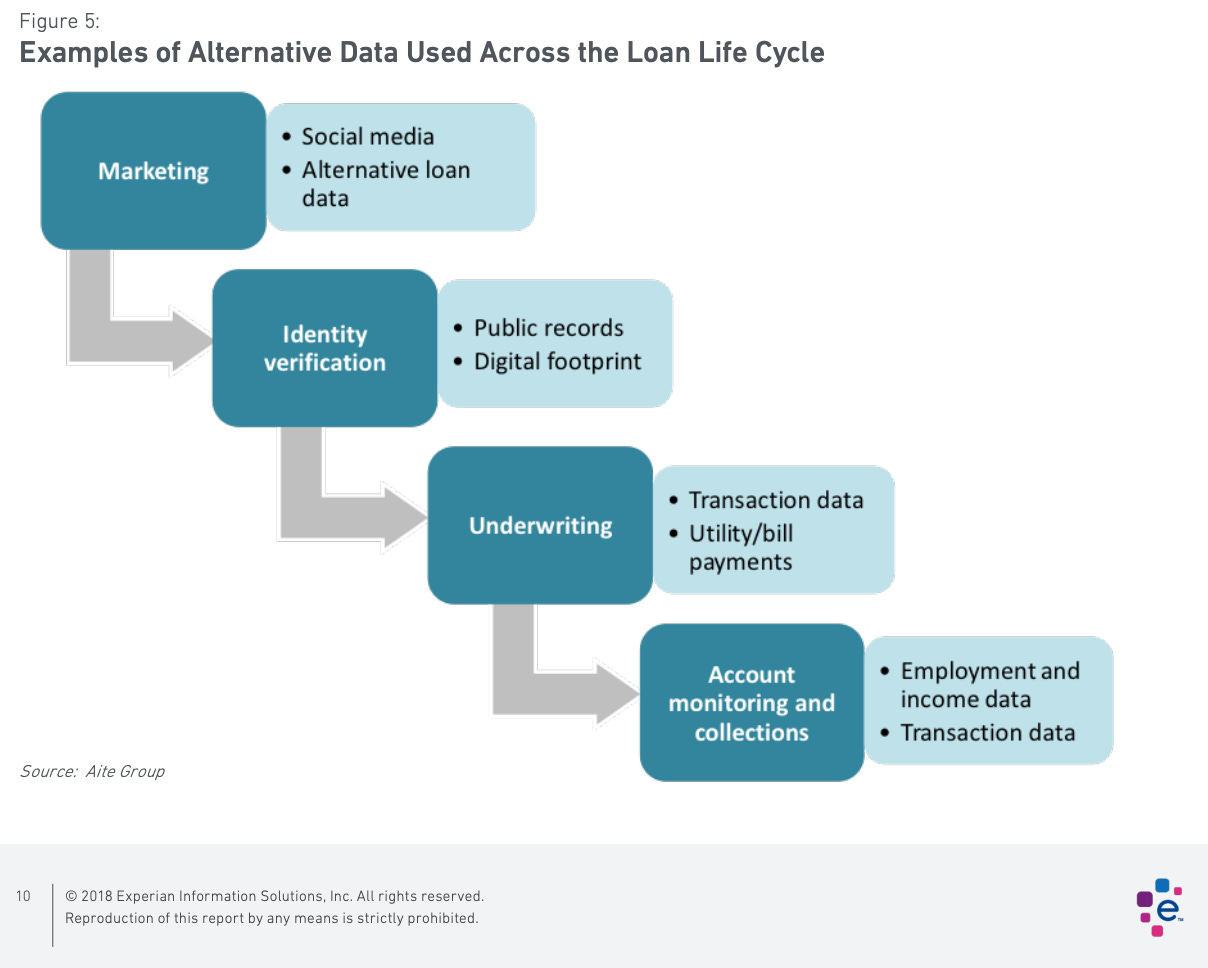

This is where alternate underwriting comes into play - taking all this seemingly inconsequential data and making concrete data points out of it. From bill payments to bank account transactions and from social media activity to your streaming subscriptions - it's all useful.

We're really not kidding about the streaming subscriptions btw. Experian, the global consumer credit rating company is letting users improve their credit scores by paying their Netflix and Hulu subscriptions on time. (Read more here)

Now you can binge-watch AND improve your credit score?!

Lend It Like OCEN ⚽️

By now, you know that the saying “data is the new oil” might just be so true.

To back it up and make it a fact, India is coming up with a new initiative. It’s as good as a fantasy land for us and is called - Open Credit Enablement Network, urf OCEN.

The importance of data is well known but where and how do we really use it? Now there are these huge big-tech platforms or e-commerce players like Amazon, Swiggy, Flipkart, BookMyShow, and some OTT platforms like Netflix playing a huge part in all of our lives.

Amazon practically knows your average annual income simply by seeing if you can afford a Mac or no. If you can, are you paying upfront or looking for the least down payment option. If Mac was a need, let’s not argue it’s still easy to judge by all your other spends, frequency, or even recharges done by using Amazon pay.

Yup, we just mentioned some data points which, if taught to a machine with relevant algorithms, would help banks figure out what amount of loan you deserve, at what interest rates, and for how long.

So, now you can binge AND shop for improving your credit score.

Wait, there’s more.

We’ve mentioned a few data points below, that are easily available with any B2B marketplace serving MSMEs. Trust us, all this fit into a model would do wonders to get working capital/cash flow loans to handle their daily biz’; as well as long term loans for the growth plans.

Only a fool would not lend them money with these data points. Where’s the issue? Well, it’s in the chaotic, yet soon to be fantasy world of MSMEs. It lacks formalization as of now, and the magic tool to turn it into fantasy land is OCEN.

Imagine a bridge connecting two ends of the road, that bridge is OCEN. On one end, it’s the borrower and on the other is the lender. The car (common medium) they use to cross this bridge is something called “Loan Service Providers” or LSPs.

Let’s get this straight with an example. Earlier we talked about binging and improving your credit score. Let’s dig a little deeper in there. All of us want to opt for the more economical option of a yearly subscription, rather than the monthly subscription. But, the pocket feels empty all at once, doesn’t it?

What if you could take a tiny little loan to pay off the yearly subscription price in monthly installments?

Your pocket remains cool, you’d have to pay much less even after considering the interest on this tiny loan, lenders make money out of the large volumes, and our LSP (Netflix, in this case) can leverage the data and get a much higher customer retention rate.

In order to do this, both Lenders (Banks/NBFCs) and LSPs (any big tech/e-commerce/marketplace) need to have OCEN compliant models. While it’s easier for the lenders to do so, we have a “supercharged turbo” for our LSP car - known as Technology Service Providers (TSPs). They will boost the already integrated systems of LSPs to get OCEN compliant and help their customers seamlessly access loans through the very same app.

That was on the consumer side. Let’s consider Shopify as an example to understand the SME loan side. Small businesses come on this platform to take their business online. Shopify takes care of the distribution for them. Shopify exactly knows the business cycle of these businesses and based on the credit period, free cash flows, and sales figures, isn’t it like a wave of a magic wand to lend them the money?

Well, you might say we still do that with Balance sheets, but they are prepared once a year. OCEN would enable borrowers to get real-time data and provide intraday loans, literally.

We were only able to give you a very basic overview of OCEN, to know more hop on to this article by the experts themselves - tigerfeathers.substack.com/p/ocen-a-conversation

To conclude, we don’t see a single reason for existing data miners to not go the lending way. Perhaps on the road more travelled by, you make some friends and prosper with them! 😉

India already has a pretty exciting digital lending landscape. Coupled with the UPI payment rails and other India Stack elements like Aadhaar, Account Aggregators, and finally, OCEN, the path towards swift scaling-up of lending services (and soon other financial services!) is not at all far away.

We’re delighted to discuss more on this - write to us, subscribe and share the word if you’re excited about this too!